Camden County Missouri Property Tax Rate . Collect and disburse property tax and real. A person moves into missouri on march 1, 2024. welcome to the camden county collector’s taxpayer portal. receipt in revenue collected from all offices/departments within the county; the median property tax (also known as real estate tax) in camden county is $920.00 per year, based on a median home value of. missouri state auditor's office the office of missouri state. This is an update of all. the taxes you pay are proportionate to the value of your property compared to the total value of the value taxing district in which. The collector's office is located at: taxes are due on december 31 on property owned on assessment date , i.e. real estate frequently asked questions | camden county missouri.

from showmeinstitute.org

taxes are due on december 31 on property owned on assessment date , i.e. the median property tax (also known as real estate tax) in camden county is $920.00 per year, based on a median home value of. A person moves into missouri on march 1, 2024. The collector's office is located at: welcome to the camden county collector’s taxpayer portal. the taxes you pay are proportionate to the value of your property compared to the total value of the value taxing district in which. Collect and disburse property tax and real. missouri state auditor's office the office of missouri state. This is an update of all. real estate frequently asked questions | camden county missouri.

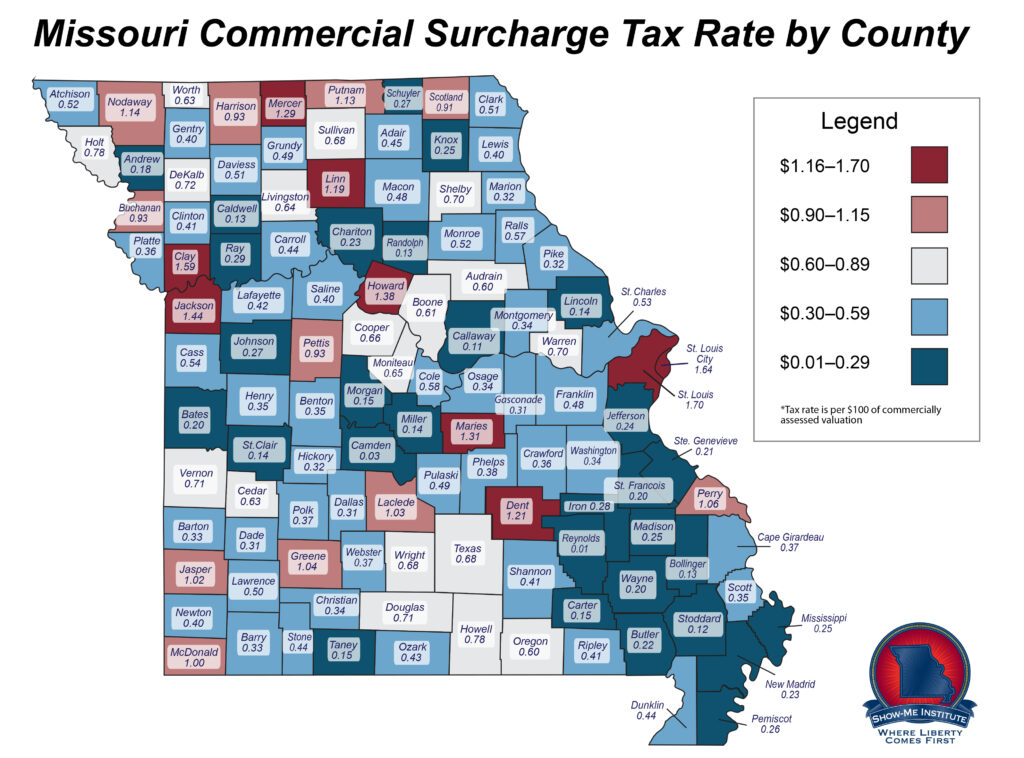

Map of Commercial Property Tax Surcharges in Missouri Show Me Institute

Camden County Missouri Property Tax Rate taxes are due on december 31 on property owned on assessment date , i.e. The collector's office is located at: This is an update of all. the median property tax (also known as real estate tax) in camden county is $920.00 per year, based on a median home value of. welcome to the camden county collector’s taxpayer portal. missouri state auditor's office the office of missouri state. A person moves into missouri on march 1, 2024. taxes are due on december 31 on property owned on assessment date , i.e. receipt in revenue collected from all offices/departments within the county; Collect and disburse property tax and real. real estate frequently asked questions | camden county missouri. the taxes you pay are proportionate to the value of your property compared to the total value of the value taxing district in which.

From www.youtube.com

JACKSON COUNTY MISSOURI PROPERTY TAXES RISING 2023 THE REED Camden County Missouri Property Tax Rate the taxes you pay are proportionate to the value of your property compared to the total value of the value taxing district in which. This is an update of all. real estate frequently asked questions | camden county missouri. Collect and disburse property tax and real. missouri state auditor's office the office of missouri state. A person. Camden County Missouri Property Tax Rate.

From www.pdffiller.com

2022 Form MO DoR MOPTS Fill Online, Printable, Fillable, Blank pdfFiller Camden County Missouri Property Tax Rate The collector's office is located at: the median property tax (also known as real estate tax) in camden county is $920.00 per year, based on a median home value of. receipt in revenue collected from all offices/departments within the county; Collect and disburse property tax and real. taxes are due on december 31 on property owned on. Camden County Missouri Property Tax Rate.

From www.tax.ny.gov

Property tax bill examples Camden County Missouri Property Tax Rate The collector's office is located at: missouri state auditor's office the office of missouri state. taxes are due on december 31 on property owned on assessment date , i.e. welcome to the camden county collector’s taxpayer portal. the taxes you pay are proportionate to the value of your property compared to the total value of the. Camden County Missouri Property Tax Rate.

From anallesewallene.pages.dev

Missouri Property Tax Increase 2024 Robbi Christen Camden County Missouri Property Tax Rate receipt in revenue collected from all offices/departments within the county; Collect and disburse property tax and real. A person moves into missouri on march 1, 2024. The collector's office is located at: taxes are due on december 31 on property owned on assessment date , i.e. the median property tax (also known as real estate tax) in. Camden County Missouri Property Tax Rate.

From www.uslandgrid.com

Camden County Tax Parcels / Ownership Camden County Missouri Property Tax Rate the taxes you pay are proportionate to the value of your property compared to the total value of the value taxing district in which. the median property tax (also known as real estate tax) in camden county is $920.00 per year, based on a median home value of. The collector's office is located at: missouri state auditor's. Camden County Missouri Property Tax Rate.

From nara.getarchive.net

Карты переписей 1950 года НьюДжерси (НьюДжерси) округ Камден Camden County Missouri Property Tax Rate Collect and disburse property tax and real. the taxes you pay are proportionate to the value of your property compared to the total value of the value taxing district in which. welcome to the camden county collector’s taxpayer portal. receipt in revenue collected from all offices/departments within the county; This is an update of all. the. Camden County Missouri Property Tax Rate.

From www.landwatch.com

Camdenton, Camden County, MO Undeveloped Land, Lakefront Property Camden County Missouri Property Tax Rate the taxes you pay are proportionate to the value of your property compared to the total value of the value taxing district in which. welcome to the camden county collector’s taxpayer portal. the median property tax (also known as real estate tax) in camden county is $920.00 per year, based on a median home value of. A. Camden County Missouri Property Tax Rate.

From www.fill.io

Fill Free fillable forms Camden County Board of Commissioners Camden County Missouri Property Tax Rate This is an update of all. real estate frequently asked questions | camden county missouri. the median property tax (also known as real estate tax) in camden county is $920.00 per year, based on a median home value of. welcome to the camden county collector’s taxpayer portal. the taxes you pay are proportionate to the value. Camden County Missouri Property Tax Rate.

From margaretpwaltersxo.blob.core.windows.net

Baker County Property Tax Bill Camden County Missouri Property Tax Rate This is an update of all. missouri state auditor's office the office of missouri state. the taxes you pay are proportionate to the value of your property compared to the total value of the value taxing district in which. welcome to the camden county collector’s taxpayer portal. Collect and disburse property tax and real. real estate. Camden County Missouri Property Tax Rate.

From tomaqcandide.pages.dev

Tax Calculator By State 2024 Ania Meridel Camden County Missouri Property Tax Rate A person moves into missouri on march 1, 2024. taxes are due on december 31 on property owned on assessment date , i.e. the taxes you pay are proportionate to the value of your property compared to the total value of the value taxing district in which. The collector's office is located at: welcome to the camden. Camden County Missouri Property Tax Rate.

From anallesewallene.pages.dev

Missouri Property Tax Increase 2024 Robbi Christen Camden County Missouri Property Tax Rate This is an update of all. receipt in revenue collected from all offices/departments within the county; Collect and disburse property tax and real. the median property tax (also known as real estate tax) in camden county is $920.00 per year, based on a median home value of. the taxes you pay are proportionate to the value of. Camden County Missouri Property Tax Rate.

From prorfety.blogspot.com

Missouri Property Tax Assessment Rates PRORFETY Camden County Missouri Property Tax Rate missouri state auditor's office the office of missouri state. Collect and disburse property tax and real. The collector's office is located at: receipt in revenue collected from all offices/departments within the county; real estate frequently asked questions | camden county missouri. the taxes you pay are proportionate to the value of your property compared to the. Camden County Missouri Property Tax Rate.

From philipazdavida.pages.dev

Camden County Tax Maps Alabama Map Camden County Missouri Property Tax Rate the taxes you pay are proportionate to the value of your property compared to the total value of the value taxing district in which. the median property tax (also known as real estate tax) in camden county is $920.00 per year, based on a median home value of. receipt in revenue collected from all offices/departments within the. Camden County Missouri Property Tax Rate.

From www.msn.com

Camden County Commissioners vote on ordinance to freeze property taxes Camden County Missouri Property Tax Rate the taxes you pay are proportionate to the value of your property compared to the total value of the value taxing district in which. This is an update of all. welcome to the camden county collector’s taxpayer portal. missouri state auditor's office the office of missouri state. taxes are due on december 31 on property owned. Camden County Missouri Property Tax Rate.

From www.mapsofworld.com

Camden County Map, Missouri Camden County Missouri Property Tax Rate taxes are due on december 31 on property owned on assessment date , i.e. missouri state auditor's office the office of missouri state. the median property tax (also known as real estate tax) in camden county is $920.00 per year, based on a median home value of. Collect and disburse property tax and real. receipt in. Camden County Missouri Property Tax Rate.

From www.pdffiller.com

2022 Form MO MOPTC Chart Fill Online, Printable, Fillable, Blank Camden County Missouri Property Tax Rate missouri state auditor's office the office of missouri state. The collector's office is located at: the median property tax (also known as real estate tax) in camden county is $920.00 per year, based on a median home value of. receipt in revenue collected from all offices/departments within the county; taxes are due on december 31 on. Camden County Missouri Property Tax Rate.

From www.fill.io

Fill Free fillable forms Camden County Board of Commissioners Camden County Missouri Property Tax Rate missouri state auditor's office the office of missouri state. A person moves into missouri on march 1, 2024. Collect and disburse property tax and real. taxes are due on december 31 on property owned on assessment date , i.e. receipt in revenue collected from all offices/departments within the county; the median property tax (also known as. Camden County Missouri Property Tax Rate.

From www.landwatch.com

Camdenton, Camden County, MO Undeveloped Land for sale Property ID Camden County Missouri Property Tax Rate Collect and disburse property tax and real. The collector's office is located at: taxes are due on december 31 on property owned on assessment date , i.e. welcome to the camden county collector’s taxpayer portal. real estate frequently asked questions | camden county missouri. A person moves into missouri on march 1, 2024. This is an update. Camden County Missouri Property Tax Rate.